September 22, 2011

- in Uncategorized by schooloftrade

Waited for Price Reversal Day Trading Euro Futures

800am est

We begin our day with the Euro, and the markets new lows has given us a challenge. We don’t have any swing lows on our 89range charts, so we don’t know where additional support is below. We then use a daily chart, a much slower timeframe, with 365 days of data, to find the levels below us. We then make note of the levels off the daily chart and use them on the 89range chart.

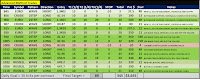

The levels off the daily are: 1.3392, 1.3358, 1.3324, 1.3203

We see three price structures on the Euro, and these tell us exactly what to do today.

Outside day, tells me to sell new lower lows with retracements.

Bear Price channel, tells me to sell new lower lows with retracements, and sell the highs of the bear channel.

Previous Range above us, tells me that as soon as the market shows signs of slowing down, we will likely see a ‘short covering rally’ which will try and push the price back into the range we just left on Wednesday.

We then use the faster 34 range chart, which now shows me intra-day levels and helps refine our plan of attack.

Three price structures on the faster timeframe…

· Bear Wedge

· Outside Day

My plan of attack will be to look for the new lows to exhaust, waiting for a price reversal to take us back up into the range above us.

This strategy only goes so far. If we keep seeing new lower lows, I will be selling retracements, however, keeping a close eye on selling into major support with oversold momentum.

Outside day tells me to keep selling retracements with new lower lows, keeping an eye on major support below us as your targets.

The bear channel tells me the same thing, sell new lower lows with retracements.

The price wedge is the variable. We are at the lows of the wedge, so we expect these lows to try and hold.

I want to buy the lows and sell the highs of the price wedge, so im looking to buy as price keeps dropping at major support levels below.

If price keeps falling, im selling new lower lows.

I have major support at 3392, 3350, 3200 and I will be looking for profit targets at that support, or for the price reversal to begin buying this back up.

If price trades sideways right here I need to be careful, we are at the lows of the bear channel.

If price rises back up im buying new higher highs with pullbacks in an attempt to get back into the range above us.

If price gets back up into the PLOD above 1.3525 we then turn INSIDE DAY and we should be looking to buy.

900am est

The Euro is challenging at the new lower lows. We are at the lows of a bear channel which makes this difficult to keep selling the lows.

We’re looking for opportunities for a reversal, and staying patient for the 21r wave patterns to the short side.

920am est

Gold futures very sloppy market personality, so we will chose to wait for better price action on the GC.

Euro has been sloppy to the short side, and we’re FINALLY starting to see buyers cover those shorts and give us some clues for the reversal.

The last 21range wave short on euro failed, and this is likely a big clue.

Crude Oil is making new lower lows and we can see 80.00 is in our sights.

945am est

We’re having some sloppy price action this morning but our simple plan is paying off!

The Mini Russell has three price structures…

Price Wedge above us is a magnet for price

Outside day tells me to keep selling new lower lows with retracements.

Major support levels below us are great for profit targets for our shorts, and entry locations for price reversals for buying opportunities.

As price drops im buying at the major support levels first, and then selling retracements with new lower lows. Im also looking for the time when the sellers exhaust and the buyers reverse this move back up. Im looking for wave failures and then take a 2step long pattern to buy the failure and bring price up to the range above us.

As price rises I’m going to buy pullbacks with new higher highs with the goal of getting up to 652.3 the PLOD. If we get above the PLOD we then aggressively buy as the buyers are now in charge.

If we trade sideways we need to be very careful not to FORCE the trades until we see higher highs or lower lows.

1030am est

We see the market personality has changed dramatically. It looks like this short-covering rally has exhausted and now traders are looking for clues.

· Do we keep rising back into the range above us?

· Do we go back and re-test the new lows from earlier today?

We are trading sideways as these markets search for another ‘catalyst’ to start moving in one direction or the other.

1100am est

Very sloppy, trading sideways. We want to wait for the 1130am European equity close and hopefully we get some new price action with the biases from Europe.

1130am est

We have still very sloppy price action, however we are seeing some options on crude oil.

Crude rally ended at 1030am, and now we look for selling opportunities below 81.00 to bring it down to the 80.00 as the final target.

89range wave short, so that is a big factor for price dropping on crude.