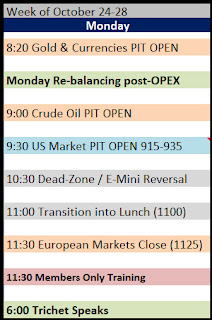

- in Uncategorized by schooloftrade

Traders react to news (or lack of) from EU Leaders Summit over the weekend

– Dollar index is trading lower this morning at the lows of the new bear price channel, the lows of the range from Friday, and below the ‘reversal-zone’ we defined last week with the bull price channel. All these signs point to a bearish dollar index. We use the negative dollar index correlation to give us clues for buying opportunities later today.

– The 2nd chart of the dollar index shows the new bear price channel and when we calculate the ‘reversal-zone’ it’s the EXACT SAME from last week’s price channel break price structure, which is very interesting indeed. We know the price will be trying to rise off these lows up into the ‘reversal-zone’, so we look for selling opportunities at the range highs on markets like crude, gold, Euro, Russell.

– short term movement on the dollar index shows higher highs, higher lows, and the move upward off these lows headed towards the ‘reversal-zone’ defined above it. So even though the slower timeframes look bearish this faster timeframe confirms the SHORT TERM trend looks more bullish. We will need to see where this goes for the dollar index this morning.

– crude oil futures are trading inside the range from Friday, in the middle of the price wedge, the middle of the price channel, and looking for price to move to the highs of the price channel to complete the ‘C’ point of this structure. If price rises I’m selling the price wedge highs and the PHOD as resistance. If we break above the PHOD 88.89 I will first look for the fake-out breakout and then buy pullback with new higher-highs on buying strength. I will then sell the price channel highs as resistance, trying to not to get caught up in buying the highs of the price channel, that will be too dangerous, sell the highs. If price falls I’m buying the PLOD and price wedge lows as support, buying the price channel lows as support, and also buying the support levels below the price channel lows.

price wedge on crude oil tells us to FADE THE HIGHS and LOWS. Sell as price rises, and buy as price falls.

– Mini-Russell Futures trading above the PHOD so outside day transition, above the price wedge below us (look for fake-out breakout), moving higher into the sell zone from the double bottom, and into the ‘C’ point from the bull price channel. We can easily tell the Russell is going to try and push higher up to the 731.5 and then we expect it to reversal and move lower all the down to the double-bottom 675.6 at the lows of the trading range and the double-bottom. If price rises I’m buying pullback above 716.8 after looking for the fake-out breakout. Keep buying pullback with new higher-highs looking for the price reversal somewhere inside this ‘reversal-zone’ above 716.8 up to 730.0 area. Looking to sell the highs of the price channel and the range around 730.-731.5, 734.4, 735.7. if price falls from these highs I will sell below PHOD 711.8, and then sell the break below the price wedge highs below 705.8 looking to take profit at the PLOD 691.5 and then selling new lower-lows with retracement down to the price wedge lows around 685.0. if price keeps moving lower we will take profit at the price wedge lows and then sell retracement down to the support below the price wedge lows as well as the double bottom for the final target to complete the mission around 675.6

Russell price channel confirms its final destination, we buy pullbacks all the way up, looking for signs of the price reversal because we are inside the reversal zone from the 89range chart.