September 26, 2011

- in Uncategorized by schooloftrade

Traders listen to news out of Europe as they prepare for a busy week starting with New Home Sales

—————————————————————————————

The James’ Report: Professional Resources for Professional Traders

—————————————————————————————

– Gold Trades at the lows of Friday’s range after a big move below it failed; outside day turned inside day, buy the re-entry inside the previous day’s range as a bullish clue

– Crude Oil trading inside the middle of Friday’s range. Trade inside day, buy the lows sell the highs of the current range.

– Euro trades at the highs of Friday’s range, inside day, sell the PHOD as resistance, then buying pullbacks above PHOD

– Russell trades above the HOD from Friday, outside day. Buying pullbacks at support with new higher highs, look for the failure above the PHOD as bearish sentiment.

– France Senate election saw Sarkozy’s ruling conservative party lose at least 23 seats and the majority

– Weekend debt talks fail to agree on solution on Greece

– IMF inspectors back to Greece this week.

– Spot Silver rebounds from 2001 lows of $26.05 to retest $30/oz in session

—————————————————————————————

Today’s Economic News:

Day traders are watching for news chatter from Europe over the weekend while they start a very busy week ahead.

This morning we have many minor Fed speakers that may be peppering the news wires this morning, but nothing major scheduled.

We begin with 10:00am New Home Sales, followed by the Dallas Fed Manufacturing Index which will be great for Crude Oil traders looking for opportunities.

Today is a Monday so we expect to see a slow start to the morning, and a possible ‘Golden Lunch’ as traders finish the day after 1130am European Close.

We will be looking for clues all morning, avoiding the times of the news, and then looking for market personality to tell us when the day is over after 1130am est.

—————————————————————————————

Looking at the Charts:

—————————————————————————————

We have three price structures on the GC 12-11 contract:

– Price Wedge

– Outside Day (transition)

– Sideways Range

Price wedge tells me to buy the lows and sell the highs of the wedge, as well as to avoid the middle of the wedge and expect a fake-out breakout when we make new highs or new lows above or below the wedge.

Selling the highs of the wedge is also trying to sell the lows of Friday’s trading range, which means selling the wedge highs will be higher risk.

Outside Day transition tells us that if we break below the PLOD we want to be selling, and if we are above the PLOD we want to be buying.

In today’s example we have conflicting structures. We want to buy above the PLOD however it is also buying into the highs of the wedge, which is not recommended.

The sideways range tells me to sell the highs, buy the lows, avoid the middle, and to expect the fake-out breakouts at the highs and the lows.

We’ve found major support at the lows (1602.9) and major resistance at the highs (1643.4) for us to use.

What if price rises and what if price falls?

If prices rise today Im selling the highs of the price wedge around 1635.3, 1640.0 and 1643.4 as resistance above the wedge.

If price keeps moving higher above the resistance of 1640.0 i will then buy pullbacks with clear bullish sentiment, always keeping an eye out for the failure (fake-out breakout) above the wedge highs.

If price drops im selling below the PLOD 1631.7 as sellers will be in charge. Im selling new lower lows with retracements and avoiding the middle area of the wedge (1620).

If price makes it all the way down to the lows of the wedge I will be very careful not trading around the BMT (1615) and will look to take profit on my short positions and enter long at the wedge lows around 1608.8- 1602.9

If price makes new lows below 1602.9 we will look for the fake-out breakout first, and then selling retracements with new lower lows.

If price trades sideways this morning we will avoid trading around the middles of the ranges, around the OPEN 1632.9 and the BMT’s on various timeframes.

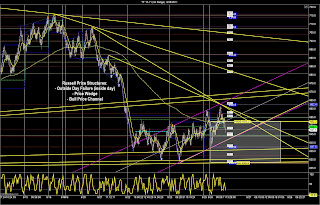

We have 3 price structures which give us easy clues for trading crude oil futures today:

– Inside Day

– Bull Price Channel

– Price Wedge

Inside day and the price wedge both have the same personality traits, they both tell us to sell the highs, buy the lows, avoid the middles, and to expect fake-out breakouts.

The price channel however, tells a different story. Price channels give us a directional bias and tells us that there will be breakouts.

Bull channel says to buy at support, buyers in charge, and to buy pullbacks with new higher highs.

If price rises on crude oil I will buy pullbacks with new higher highs and buying at the lows of the bull channel unless it is at the highs of the price wedge, and I will avoid buying into the highs of the wedge.

I will look to sell the highs of the wedge first, and then if those highs are broken I will look for the fake-out break and then if we see strong buying i will buy pullbacks above the 81.00 for the best opportunities to the long side.

If price falls im buying at the lows of the bull channel as major support and buying at support levels below the channel lows.

Im buying the support levels as price falls, and buying the PLOD 78.36. If price breaks below the PLOD we then turn OUTSIDE DAY and the sellers are in charge so we sell new lower lows with retracements.

We have major support down at 77.11 so if we break below the PLOD I will be selling down with retracements to this major support and then buy this major support as the lows of a major price wedge.

If price trades sideways I will avoid the OPEN 79.66, avoid the middle of the range trading ranges.

Euro futures have three easy price structures we can use today:

– Inside Day

– Sideways Range

– Price Wedge (bear)

All three of these tells me to buy the lows, sell the highs, avoid the middles, and look for the fake-out breakouts at the highs and lows of the ranges.

As price rises im selling at resistance. As price falls, im buying at support. I am trying to avoid the middle of any trading range big or small.

If price rises im selling the wedge highs and the resistance above the wedge highs. If we break above the 3600 then I can start looking to buy with new higher highs, however, on the way up we expect the failures, so sell as price rises.

If price falls im buying support below and the lows of the price wedge. Im buying the PLOD as support, and then if we break new lows below that PLOD we start selling aggressively as the sellers are in charge now.

As price keeps dropping im buying major support 3357 and then buying the lows of the bear price wedge just below it.

I can sell retracements all the way down below the PLOD until i run into the major support levels, and then I will buy.

If price trades sideways i will avoid the middle of the trading ranges, waiting patiently to sell the highs or buy the lows.

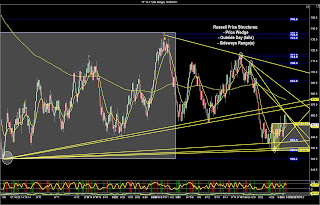

We have three price structures on the Russell today:

– Price Wedge

– Inside Day

– Bull Price Channel

Price Wedge and Inside Day both have the same personality traits, they tell me to sell the highs, buy the lows, avoid the middles and expect the fake-out breakouts.

The bull price channel tells me to buy pullbacks with new higher highs, and to buy at the lows of the bull channel, as well as the support below the bull price channel.

If price rises im selling the PHOD as resistance first and then selling the Wedge highs and the resistance above the wedge highs looking for the fake-out breakouts.

If we get above the PHOD the buyers should be stronger than the sellers, but remember the price wedge reminds us to be very careful trying to buy into the highs of the wedge.

As price rises im selling at resistance, and as price falls im buying at support.

If price falls im buying the wedge lows 645 area and if we break new lows below this wedge we look for the fake-out breakout first, and then we sell retracements down to 637.5 which is the next major support. I will buy the 37.5 as support as price drops.

If we keep dropping below 37.5 we keep looking to buy at 32.3, 28.1 which is the PLOD as support. If we break below the PLOD we then have the sellers in charge we are selling aggressively with retracements.

—————————————————————————————