August 26, 2011

- in Uncategorized by schooloftrade

Summer Friday; Traders Wait for GDP and Bernanke to give us opportunities today

—————————————————————————————

The James’ Report: Professional Resources for Professional Traders

—————————————————————————————

– Ahead of the later today speech by the Fed’s Bernanke, European equity indices opened the session flat to slightly higher. However, markets have since moved off of the best levels, as some of the larger European banks have moved into negative territory, despite the extension of short selling bans in EU countries including Spain, Italy and France. Overall, the equity weakness is being led by the German DAX amid concerns related to the country’s political situation and the costs of the EU’s bailout agreements.

– Japan PM Kan formally steps down from leadership of DPJ

– US Q2 GDP data due out at 830am and Fed Bernanke speck from Jackson Hole afterwards

– German import prices higher than expected

– In an interview with Professor Robert Mundell, the ‘Father of the Euro’, the Telegraph’s Evans-Pritchard noted that we are in very serious danger. Mundell believed the world is in a depression in the Big Three of America, Europe and Japan. This is a mini-depression that we have not seen since the 1930s. Mundell said that shared governments are needed to move the EU in the right direction. There are large problems in five or six EU states, but the solution is not the end of the Euro since this would create more problems than it solves. He did mention that it would be helpful if the ECB revised its price stability mandate, and pegged the Euro to the USD at $1.30 since he thought the EUR is too strong.

– Hurricane Irene Loses strength as it heads to mainland US

—————————————————————————————

Today’s Economic News:

Looking at the news this morning we know right away today is a summer Friday so we need to keep our eyes on the clock. Get in early, be selective, and then be disciplined not to over-trade if the markets get slow and sloppy after 1030am today.

We begin the day with the Jackson Hole Summit again today, which means all eyes will be on the news chatter coming out of that meeting.

We have 830am GDP this morning which is always a bit of a sloppy news release. We will look for good volume after 830am this morning, but in my experience the GDP number is usually already priced into the market and the moves are ‘usually’ limited, however, I hope im wrong on that and we get some great moves.

After we get through the US Open at 930am this morning our last news event is 955am Consumer Sentiment which will likely be the last push of volume today.

We have Ben Bernanke speaking at 1000am from the Jackson Hole meeting, followed by Trichet from the ECB at 1230pm today.

With that said, looking for volume early, but the summertime Friday and the Jackson Hole Summit means expecting price action to get sloppy after 1030am today and will likely be sitting on hands as of 1100am est.

—————————————————————————————

Looking at the Charts:

—————————————————————————————

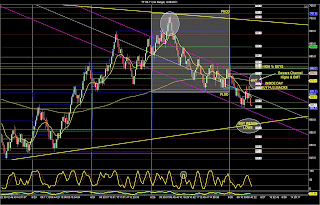

Crude Oil:

– Inside day

– Price Wedge

– Sideways Range

My plan of attack on crude oil this morning will be to buy the lows and sell the highs of the range we are in.

Inside day tells me to buy the PLOD as support, and then if we break below 83.01 PLOD then the sellers are in charge we want to aggressively start selling retracements.

If we start selling off we then look to buy at support first, but we need to be aware if the sellers are too strong we will wait for new lows breaking support and then sell retracements.

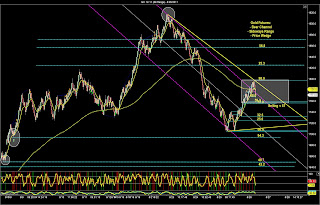

Gold Futures:

– Bull Price Channel

– Price Wedge (wide)

– Inside Day

Bull Channel says to buy at support if price falls and to buy new higher highs with pullbacks.

Inside day tells me to sell the PHOD as price fails to break above it.

Inside day tells me to trade inside the range im in currently. So buy the lows and sell the highs of the current trading range.

Price Wedge (we are at the highs) tells me to sell the highs of the wedge and look for the lows of the wedge to be a final profit target.

We can see the 1759.5 as the line in the sand. If we break below 59.5 we then need to sell retracements because the highs of the wedge, the outside day failure, and the break of the bull channel.

Russell Futures are trading in a bear channel and we recently saw the PLOD break and its an OUTSIDE DAY, however, the double top at the PLOD says it may fail and go back up into the range from Thursday.

Bear channel says to sell new lower lows with retracements

We want to buy at support first, and then if support breaks we then sell retracements.

—————————————————————————————