September 27, 2011

- in Uncategorized by schooloftrade

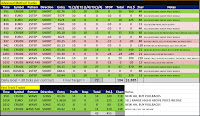

Didn’t they listen to me this morning? Price Wedge day trading earns over 180 ticks

The first thing I do this morning is try to identify the market that is moving the best today.

I want consistent price action, lots of speed, lots of BIG money in the market, and lots of trading opportunities, so which markets do I chose first?

I want to start with a market that is at the highs or the lows of a range, not in the middle of a range. I want OUTSIDE DAY’s and I want a moving market.

815am est

Euro futures has three price structures:

– Outside Day

– Price Wedge

– Bull Price Channel

Outside Day and the Bull Channel both have the same market personalities, they tell us to look for breakouts, buying pullbacks with new higher highs and buying at support as price pullbacks off those highs.

Price wedge has a complete OPPOSITE personality. It tells us to sell the highs as price rises, and look for fake-out breakouts. This is very different than the first two price structures.

The Price Wedge is the most important until we are told differently. If we see support levels hold during pullbacks we then can feel confident that we’ve ‘broken’ the price wedge.

Our plan of attack will be quite simple. We need to use the wedge first, and then when we see the pullbacks hold, rather than collapsing into the wedge below, we then know the price action is bullish and we can start aggressively buying now.

If price rises im aware of the fake-out breakout with a price wedge so im trading with caution when using wave patterns at the new highs.

If the buyers can hold above the PHOD 1.3563 we then see this as bullish and we will then buy pullbacks with new higher highs.

It does feel like this has a fake-out breakout written all over it.

As price rises im selling at resistance first, and then if that resistance breaks, i then look to buy a pullback.

I will sell the highs of the bull channel if we make it up that high today.

If price falls im selling aggressively below the PHOD as a FAILURE of the Outside day. I am selling aggressively below the highs of the price wedge, sell the highs of the wedge.

I will buy the bull channel lows at 1.3500 as major support. If price breaks through the channel lows i will then buy the support below the channel at 3486, 3475.

If we break thru the 3475 support I will then consider the sellers in control and will sell retracements down to the 3420 which is major support from our 89range chart.

905am est

The Crude Oil Futures have three price structures:

– Outside Day (transition)

– Bull Price Channel

– Price Wedge

We use the price wedge first, so we are looking for fake-out breakouts above the highs of the wedge.

The bull channel and the outside day both tell us to expect big moves with breakouts to the up side. However, the price wedge is more important first, so we look for the sellers at the highs to fail and then we can proceed using the bull channel as our guide buying new higher highs with pullbacks.

My plan of attack on crude oil is to sell as price rises and then above 83.14 we should be ok to start buying pullbacks considering the wedge will be broken.

If we end up back below the PHOD we then look at the sellers in charge so we want to be selling below 82.24.

If price rises im selling at resistance until we break above 83.14 and then I will wait to see the sellers fail and then with strong buy pressure I will buy a pullback up to 84.00.

If price falls i will sell aggressively below the PHOD 82.24 down to 81.83 and 81.54. I will take profit at these levels of support, and then with new lows below these major support levels we will start selling retracements with new lower lows.

1030am est

We can see the market personality is changing dramatically. We are not getting any consistent movement in one direction, and the sloppy price action is making it hard to manage trades without a lot of risk per trade.

We need to slow down, step back, and find the highest percentage trades now that the market personality isn’t as good for us.

1040am est

Crude Oil buyers are just barely strong enough to keep pushing new higher highs. The concern is that momentum keep going overbought at these highs, and we then look to sell, but there isnt any consistency when we see the highs.

We can see the overhead resistance of 84.62 from our 89Range chart as the goal for where the buyers are trying to go, however, we also have the 89r BMT at 83.51 which is a price magnet and will keep trying to drag price back down.

1045am est

Bull channel on the 13range of crude oil tells us that buying support will be higher percentage.

Beware trying to sell short into the channel lows.