- in Uncategorized by schooloftrade

day trading strategies for professional traders

The Dollar Index is trading in a bullish price channel, we are above the major trigger zone, and we found an AB=CD Pattern to confirm where this price wants to go in the future. We expect to see much different personality when we get up to 79.500.

The Dollar Index 13range shows us a strong bull channel, and a double-top. These are short term trends and patterns so these can change quickly. Look for the dollar index to drop into the buy zone and trade accordingly.

![]()

The euro is trading in a bear price channel with a major AB=CD Pattern that shows us the overall direction for the next few weeks. We want to use this direction as our guide.

Euro 89range shows us much more detail, and we see another bear price channel as well as a short term AB=CD Pattern. Remember the concerns with selling the lows of the channel, so wait to see a bounce off the lows. use a 2step long to buy the lows, and then look for the wave short off the lows.

Euro 34range shows us a lot more detail, and builds our confidence in the long side of this trade. AB=CD confirms we are ready to move higher, and the trigger zone and PLOD/OPEN are excellent price magnets.

Our trading strategy for the euro will be to buy the lows of this channel and take profit up at 1.3460 area.

Gold Futures trading in a bear price channel, we see the AB=CD pattern to tell us direction and location of the move. We also see in the MIDDLE of the range from Tuesday, so beware this sloppy price action in the middle.

If price rises im selling the channel highs as resistance. I will look for a short term buy above the PHOD and take profit at the channel highs around 1720.0 area. If price falls i will buy 84.5 and the PLOD as support, and then sell below the PLOD knowing the AB=CD pattern is in effect.

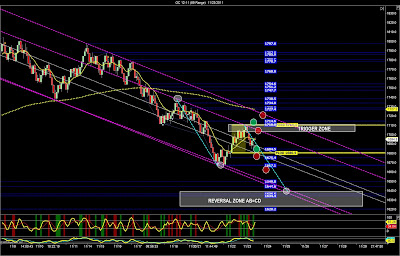

Crude Oil Futures trading in a new bear price channel, outside day below the PLOD, inside the minor trigger zone below us, and inside a price wedge.

If price rises we want to buy above the trigger zone, and buy above the PLOD. Take profit at the bear channel highs, and then sell the bear channel highs. If price keeps moving higher than the PHOD i will buy a pullback above the PHOD 98.65 and take profit at the next resistance overhead 100.30

if prices move lower I will buy the wedge lows and the 95.19 major support. I will sell the break below the zone below 94.55 and remember not to sell too close to the channel lows, so timing on that entry below 94.55 is vital.

The 34range on crude oil futures shows us exactly where to be buying and selling today. We see double tops and bottoms that will give us excellent buying opportunities at the wedge lows.

The mini-russell is trading at the lows of the bear channel and we want to buy these lows.

The mini-russell day trading strategy is to use this sideways range at the channel lows to give us the clues we need for the highest percentage trading opporutnities today.

If price falls I will buy the channel lows, and the support levels below the channel lows. If price rises I will buy above the 81.7 and then sell the range highs at 89.5. If price moves above 89.5 I will buy pullbacks with the target of the PLOD 94.4