November 28, 2011

- in Uncategorized by schooloftrade

Day Trading Strategies for Euro, Crude, Russell and Gold futures

—————————————————————————————

The James’ Report: Professional Resources for Professional Traders

—————————————————————————————

Let’s review today’s day trading strategies together in the live trade room

—————————————————————————————

Around the Globe this morning:

– European shares rallied extending last week’s rebound as investors anticipate positive developments over the debt situation in Europe ahead of the EU summit on December 9th. New rules draft for EFSF circulated in the financial press noting that the enhanced package would offer partial protection of as much as 30% to investors. Banking stocks benefitted from the news. Italian banks also soared after speculation that IMF was in talks with Italy for a financing package of €600B with a rate in the range of 4-5% which would give the country breathing room as it implements its austerity measures. Although the reports were denied by the IMF and other official sources, the article from La Stampa continued to sustain European markets, in the hope that maybe where there’s smoke, there’s fire. On the other hand, a worrying report from Moody’s warned that the probability of multiple defaults by the euro zone countries is no longer negligible.

– IMF stated that it had NOT had any discussion with Italy regading financing (confirms earlier press speculation)

– Germany Finance Ministry (MOF) confirmed press speculations that there were no plans to issue joint bonds among AAA-rated euro zone countries

– OECD issued its semi-annual Economic Outlook which stated that policy makers must act on debt to avert global economic slump. ECB should cut rates and continue non-standard measures while the Fed still has room to support economy.

– OECD Chief economist stated that the numbers circulating on EFSF facility’s firepower was currently not enough

– Germany Gov’t spokesperson reiterated the view that Germany did not have unlimited financial strength. Chancellor Merkel to give speech on debt crisis on Friday, Dec 2nd and stressed that Germany was skeptical about any ‘bazooka’ to solve the current crisis (in line with Merkel’s views on one-off solutions)

– Austria Debt Agency (AFFA) canceled its plan auction for Tuesday Dec 6th citing better budget developments and noted that it had completed its 2011 bond funding program

– UK Chief Treasury Sec Alexander commented ahead of Tuesday OBR release that the Govt to stick to its budget plans

– India PM’s econ adviser Rangarajan reiterated view that Inflation would start to decline as of Nov and be at 7% by end of FY12 (March). He expected India’s inflation rate to be at 6.0% in FY13 (begins in April 2012) with a medium term objective is to have inflation at 5%

– Singapore central bank signed MOU with Malaysia’s central bank for collateral agreement for enhancing liquidity to banks in both countries

– Reports of IMF package for Italy not credible

– EU Ecofin meeting this week; Euro Zone weighs plan to accelerate fiscal integration

– Large amount of EU debt supply over the course of the week

– ECB’s Noyer: EFSF increase unrealistic

– US. Black Friday sales hit record levels

– The largest electronic foreign currency trading platform, Icap, is testing its EBS platform to trade the Greek drachma against both the EUR and USD, in preparation for a possible euro zone collapse.

—————————————————————————————

Today’s Economic News:

Our day trading strategies today will depend on the news, and today is a Monday after a Holiday weekend so we know the news is very important to wait for this morning.

We begin the week coming back from the long weekend, which means our main focus this morning is getting back into the rhythm of our trading routine, not forcing trades too early this morning, and being patient for the best market personality to come our way as people come back to their desks after a long weekend.

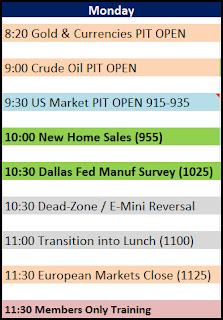

We begin the day with the 930am EST US Markets Opening, when we will grab the e-mini Russell and sit on hands after 915am EST waiting for it to pass. Once we move through the OPEN we then move to 1000am EST New Home Sales and then 1030am Dallas Fed Manufacturing Survey, both of which will be major news events. We need to stay patient for this today because we may not get much personality BEFORE the US Open, considering the holiday weekend and everyone coming in late to the morning session.

As always, Monday’s have potential to see a late morning move, so keep an eye on the clock after 1100am EST today looking for clues of the market heading into lunch, OR continuing to move well and we can keep trading into 1130am EST.

We will be doing an intense training today with members only @ 1130am EST in our private trade room discuss the Auto Trader SCALPER Strategy with members as we finish up our day.

—————————————————————————————

I’m always improving this prep, I appreciate your feedback, please post it here!