- in Uncategorized by schooloftrade

Day Trading Strategies for Dollar Index , Euro, Crude, Russell and Gold futures

We begin our day with the dollar index, and with the news out of europe overnight we expect to see the dollar continue to rise with the euro potential falling to new lows.

We begin with the 13-range chart for the Dollar Index, which is fast enough to show us the short-term trend on the dollar, which is the most important aspect we use with the dollar. We can see the bullish price channel which tells us to expect higher price, and then we use the trigger zone to find the support area held 78.595 and then we added the price channel strcuture and found that A, B, C, and D all lined up perfectly to give us another reason why this dollar should keep rising.

Crude Oil 34range chart is trading in a bull channel, inside the range from Monday, and within a price wedge. We need buy the lows, sell the highs, and avoid the middle of this channel and price wedge.

Crude Oil Futures trading in a narrow price wedge, inside the range from Monday and lots of support below and resistance overhead. The key to this price structure is being patient buying the lows at 100.25 and selling the highs at 102.00-102.45

Crude Oil 21 range chart shows us exactly where we want to be trading this morning. Looking to buy these lows around the 100.50 area.

Crude Oil 13range chart shows me more details, including the new short term bullish price channel and the specific buying locations on this chart.

The best way to trade crude oil this morning with the dollar index rising to new higher is to wait to buy at the lows and then if we break new lower lows then sell a retracement. Use the colored circles as your guide.

The Euro currency futures 89Range chart shows us the bear price channel, the price wedge, and the Inside Day at the PLOD. We need to buy these lows and sell the highs of the wedge, while keeping an eye on the dollar index correlation. If the dollar keeps movign higher we need to be very careful selling into these lows. Selling below 1.3333 and buying on the way down before we get there.

The Euro 34range chart shows us more of our day trading strategy. Buy the lows and sell the highs of this price wedge, making sure not to trade in the middle, or try to buy above the wedge highs. As price falls i will buy the wedge lows first, and then if the dollar index keeps rising and the price keeps falling we will then sell retracement below 1.3333. I am buying on the way down. If price goes below 1.3333 we sell retracements taking profit at the Double-Top max extension at 1.3300

The euro 21 range chart shows us the AB=CD Pattern which gives us the buy zone below us, and with the price wedge we know we need to focus on the wedge first, buy the lows and sell the highs, and then if price moves lower below 1.3333 we know WHERE it want to go, so we can trade short down to the reversal zone and then take profit in the zone around 1.3260. If price rises up im selling the highs around 1.3400-1.3425 area and then if price keeps going higher I will buy above 1.3429 however it will be higher risk to buy above the wedge highs so beware.

Gold Futures trading in a price wedge just below the short term trigger zone which is support. We are in the middle of the wedge so trading cautiously, and remember that if we break the lows below 1711 we can sell short with retracements down to 1695.0. Take profit off at the big round number 1700 and then hold the rest for the wedge lows.

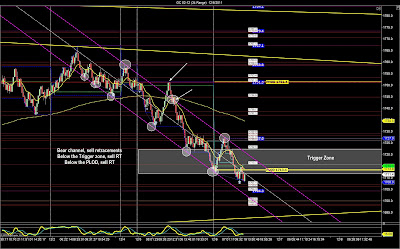

Gold 34range chart shows us a short term bear channel, below the range from Monday and below th short term trigger zone from the swing low to swing high. We know this tells us to sell retracements with new lower lows. As price falls im selling retracements taking profit at support 1704.3 and big round number of 1700.0 before the final target of 1695.0 the lows of the wedge. If price rises im selling the highs of this channel around 1720.0 and selling the resistance above the channel at 1727.0

The Russell has been sloppy all morning without any major US-based news to work with. The Russell trading in a very narrow price wedge, inside the range from Monday, so we need to stay away from the middle, and buy the lows, sell the highs of this range.