December 8, 2011

- in Uncategorized by schooloftrade

Day Trading Strategies for Dollar Index , Euro, Crude, Russell and Gold futures

—————————————————————————————

The James’ Report: Day Trading Strategies for Professional Traders

—————————————————————————————

Around the Globe this morning:

– EU Leadership Summit Begins

– European shares rose ahead of the anticipated rate cut from the European Central bank due out in NY morning. The summit on the 9th of December is also lifting the shares even though German and French officials have tried to downplay the expectations.

– ECB is expected to cut its rate to 1.0% from 1.25% as central bank’s monetary policy is shifting towards an expansionary phase, even though there have been no plans for bond purchasing. However, traders are eyeing any hint of a European quantitative easing in an effort to contain the crisis.

– Some Europe Central Banks weigh contingency plans for possible Euro Zone

Exits or an entire breakup

– German Chancellor Merkel could call for new EU Summit later in December should the current meeting fail to achieve its goals

– ECB borrowings at highest level since March

– Australia Nov Unemployment Rate rises for the first time in three months

– The price action was limited ahead of the BOE, ECB rate decisions and the start of the EU Leader Summit. The ECB is again expected to cuts its key refi rate by 25bps but the central bank likely to focus on ways to assist the region’s banking sector and not be a lender of last resort to governments.

– The FT reported that European private equity volumes drop to the lowest level since financial crisis. According to Dealogic, the buy-out market in Europe declined to $11.5 billion in the current quarter-to-date, approximately one fifth of the fourth quarter 2010 transaction volume, and the lowest level since the second quarter of 2009.

– Officials at EU summit in Brussels remained at crossroads, as differences remain exposed ahead of the discussions. German representatives are said to remain unyielding, calling for EU-wide changes to the treaty containing legal requirements. The German government also remained opposed to different possibilities of boosting the EFSF.

– Ambrose Evans-Pritchard looked at expectations for Thursday’s ECB meeting. Sources in Frankfurt believe that the meeting will focus on ways to save banks and not states. The ECB could lengthen the maturity on loans to 2 years and possibly relax collateral rules. It expects interest rates to be cut by 25bps to 1%, although such a minor cut might not be enough to slow the contraction in the money supply. With regards to the French/German fiscal union proposal, some believe that the proposal is not enough to give the ECB room to act further.

– The Financial Policy Committee (FPC) instructed British banks to disclose leverage ratios by 2013, two years earlier than expected, per instructions contained in the Bank of England’s Financial Stability Report. Currently, banks are obliged to disclose only capital ratios. Note that the Basel III rules require leverage ratio calculations by 2013, and disclosure to investors from 2015. At the moment the FPC has only an advisory role, but new rules will make it the UK’s top financial regulation body beginning 2013.

– The Indian Prime Minister was forced to withdraw plans to allow foreign chains to open in India following a fortnight of public protests, and coalition support for the main BJP opposition party to block the move. The plan was suspended until there was a consensus with various stakeholders stated the Finance Minister. Supporters see the plan would transform the inefficient farming industry by creating a proper transport infrastructure, while critics state that the entry of companies such as Carrefour, Wal-Mart would cause the end for hundreds of thousands of family-owned shops which control 95% of the country’s £286 billion retail trade.

—————————————————————————————

Today’s Economic News:

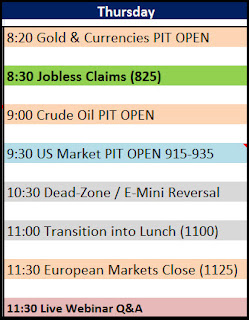

Our day trading strategies today will depend on the news. This morning all eyes are on the jobless claims report at 830am EST today. Last week we saw reading above 400k for jobless claims, and another reading above that level this week will show signs of deterioration in the jobs market, and the underlying recovery.

We start with 830am EST news, and then move to the 930am EST US Open when we grab the Mini-Russell Futures and then head into our reversal at 1030am EST before our transition into lunch after 1100am EST today.

At 1130am EST the european markets close and we will be looking for personality clues along the way telling us when the morning trading session will come to an end.

We will take all your questions after 1130am EST today for our live open webinar. We’ve had a great week so far, lets keep it going!

—————————————————————————————

I’m always improving this prep, I appreciate your feedback, please post it here!