December 5, 2011

- in Uncategorized by schooloftrade

Day Trading Strategies for Dollar Index , Euro, Crude, Russell and Gold futures

—————————————————————————————

The James’ Report: Day Trading Strategies for Professional Traders

—————————————————————————————

Around the Globe this morning:

– European shares rallied in today’s session following Italy’s announcement of new austerity measures and the meeting of Sarkozy and Merkel. The Italian government announced new measures which would include a €20B in cuts and €10B in stimulus through 2014 aimed at promoting growth and employment. Merkel met Sarkozy in Paris today to advance a plan for stricter rules on deficit ahead of the much-anticipated EU summit on December 9th. Markets have hopes that the EU officials will advance with a solution to the EU’s debt crisis.

– European PMI services data was mixed: Italy, UK and France data was better than expected and rose m/m.Germany PMI services missed expectations while the German Nov final composite index had its first contraction since July 2009; Spain services PMI hits lowest level since March 2009

– Italian, Spanish equities lead gains as bond yields continue to move sharply lower

-Belgian banks outperform as the government’s 6 political parties approved the coalition agreement

– ECB daily borrowings remain elevated on session

– Chinese yuan trades at lower end of trading band against US

– The former Pension Secretary Lord Hutton said over the weekend that the British pension reforms may not be enough to control rising costs following review of the system. The findings looked too optimistic following the downgrage of growth forecasts by the Office for Budget Responsibility (OBR). According to Sky News, the Work and Pensions Secretary Iain Duncan Smith supported Lord Hutton’s comments, and said, “The unions who went on strike are living in a slightly unreal area. There simply isn’t the money they think there is to pay the pensions”. Note these comments follow last week’s High Court ruling that the pension changes are lawful.

– The FT reported that British banks will encounter increasing costs to raise finance in traditional bond markets. Some institutions will continue to be completely blocked due to increasing collateral demand from other lenders is undermining the strength of their balance sheets according warnings by the Bank of England. The central bank stated that the issue of secured lending to banks is creating more worries for regulators and markets.

– The FT commented on the developments of the Belgium coalition noting that the six political parties approved the coalition agreement, which includes 2012 spending cuts and tax increases of approx €11.3 billion, major transfer of powers transferring from federal to regional level (Flemish requests). The members of the coalition are expected to be finalized negotiations set for Sunday night. The coalition will not have a majority among Flemish members of the federal parliament. It is expected that the coalition will survive the 2014 elections.

– Italy announced its austerity package, which includes an additional €10 billion in measures to boost growth and jobs. The budget has €20 billion in cuts and €10 billion in stimulus through 2014. Other components of the budget include the increase in the minimum pension age to 66 by 2018, VAT tax hike by 2 points from 2% starting September 2012, and no plans to raise income taxes.

—————————————————————————————

Today’s Economic News:

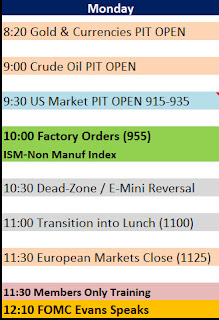

Our day trading strategies today will depend on the news, and this morning we have important news for crude oil futures and the manufacturing sector of the US.

Today is a Monday without any major news before 930am US Open so we will expect a little sluggish start to the day and week. Once we get through 930am EST we should see better market personality.

We have our first news of the day at 1000am EST today with Factor Orders, and ISM Non-Manufacturing. Latest reports on manufacturing have been decent, so this is another opportunity to solidify our confidence in that sector.

Once we get through the 10am news its hard to tell what the market’s personality will be like, considering it’s a Monday, and we have a Fed Speaker Evans at 12:10pm EST this afternoon. We don’t expect the markets to be waiting for Mr. Evans to speak, but we do consider this to be a sign that we may get slower price action after 1130am EST so keep an eye on the clock.

Monday’s are always a little slow start, so stay patient, wait for your best opportunities and remember you have the whole week ahead of you today.

—————————————————————————————

I’m always improving this prep, I appreciate your feedback, please post it here!