December 1, 2011

- in Uncategorized by schooloftrade

Day Trading Strategies for Dollar Index , Euro, Crude, Russell and Gold futures

—————————————————————————————

The James’ Report: Day Trading Strategies for Professional Traders

—————————————————————————————

Around the Globe this morning:

– The concerted act from major central banks to lower interest rate on fx swap lines was a boon for European equities markets and other global bourses. ECB along with the Fed, BoJ, BoE, SNB and BoC were prompted to act in order to provide liquidity and ease the effects of credit crunch in global markets. However, the rally did not last throughout the session after grim remarks from ECB’s Draghi who warned of downside risks. While noting that he was aware of difficulties banks were facing, the ECB’s chief hurried to point out that ECB’s action would be limited and temporary.

– The Telegraph commented on yesterday’s move in Germany’s 12-month bill yield to below zero. This move could be an indication of strains in the money market. World First Economist Jeremy Cook stated the negative yields could have been a sign that the money markets were under severe strains. The German one-year yield moved below zero ahead of the news that global central banks would lower rates on fx swap lines in a move to ease money market conditions. There was an unsubstantiated rumor that a large European bank was in trouble. A related article in the FT attributed the move lower in German yields to speculation that the ECB could cut rates in December.

– The Guardian reported that EU ministers warned that it must save the euro in 10 days or see EU fall apart. The warning from EU commissioner Rehn came following the intervention by the central banks. He said the EMU will either have to be completed through much deeper integration or we will have to accept a gradual disintegration of over half a century of European integration. EU finance ministers were told bluntly that unchecked debt and banking crisis would push Europe into a deep slump affecting the rest of the world. The EU president Van Rompuy added that the trouble has become systemic, and that we are witnessing a fully blown confidence crisis.

– Sky News reported that the City regulator Financial Services Authority (FSA) FSA informed Britain top banks to plan for euro zone split. The FSA head Hector Sants told the financial institutions to accelerate plans for a separation of the single currency area. The meeting was not specifically meant to issue the warning, however, it was suggested that banks should run a wide range of stress tests as part of their contingency planning. No specific instructions or scenarios were mentioned. According to Sky News, people close to the FSA said the warning was the kind of contingency planning expected in a situation like this.

—————————————————————————————

Today’s Economic News:

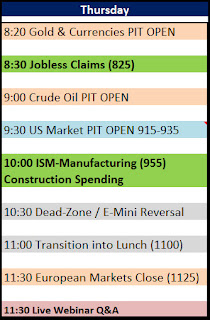

Our day trading strategies today will depend on the news. This morning our day begins with 830am EST Jobless Claims which will get the volume started early. We then move through the 930am EST US Market Open, at which time we will grab the mini russell and then at 1000am EST we have ISM-Manufacturing and Construction spending, which will have a big impact on crude oil futures because of the demand factor related-to Manufacturing data right now.

After our 1000am EST news we don’t know what to expect. We have major news on Friday morning that we have to assume will be on the minds of traders late in the morning this morning, so keep an eye out for changes in market personality. We will be watching the clock after 1045am EST looking for clues that Non Farm Payrolls on Friday morning are starting to take away the volume in the market.

Today is Thursday, so we will be finishing up the day with a live webinar with guests and members, so stick around and ask lots of questions with us today after 1130am EST.

—————————————————————————————

I’m always improving this prep, I appreciate your feedback, please post it here!