- in Uncategorized by schooloftrade

Day Trading Morning Prep Gold, Crude Oil, Dollar Index, Euro, E-mini Russell Futures

8:20 Gold & Currencies OPEN

Lets look at the markets we trade most…

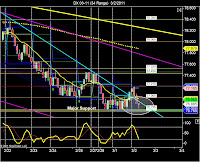

- Wedge Pattern n yellow trend lines

- Sideways trading range

- Previous HOD and Previous LOD

we see three things to watch:

- Price Chanel

- Sideways Range

- Previous HOD and Previous LOD

Remember this key rule: If price falls, im a buyers first, seller second. If price rises im a seller first, a buyer second.

We see the dollar index has had its effect on the euro this morning. Double tops on the euro match double bottoms on the dollar, so lets watch the DX for clues on day trading the euro.

We see the dollar index has had its effect on the euro this morning. Double tops on the euro match double bottoms on the dollar, so lets watch the DX for clues on day trading the euro.If price keeps dropping we want to buy at support of 3742, 3710, 3700, 3632 all the way down.

Im going to be a buyer first as price drops to support levels on the way down.