October 3, 2011

- in Uncategorized by schooloftrade

Buy the Lows and Sell the Highs day trading Crude Oil and Mini-Russell futures

Today is a Monday, new week, new month, new quarter, and our plan of attack is simple; get back into the routine that made us successful last week, month, quarter.

My job today is to get back into my routine, because my routine will build my confidence, allow me to stay patient, and with that I am free!

830am EST

US Dollar Index is trading sideways this morning on a Monday without news before 930am EST.

We know the sideways dollar tells us that either direction is likely today. Without a solid short-term trend on the dollar, we can’t assume a directional bias this morning YET.

Looking for higher highs, lower lows, a steep slope to our trigger line on the 13-range chart of the dollar index. This will tell us when there’s a trend and we will then trade opposite to that trend.

845am EST

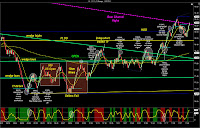

Crude oil futures trading with three price structures:

– Outside day (transition)

– Price Wedge

– Bear Price Channel

Outside day says to keep selling retracements with new lower lows. Also tells us to buy the re-entry above the PLOD if we fail at these lows.

Price Wedge tells us to beware the reversal at these lows, expect the fake-out breakout. Price Wedge personality says to sell as price rises, and to buy as price falls.

If we break out of the price wedge we expect the price reversal after the buyers or sellers fail to move price higher or lower.

Price channel is to the downside, tells us the higher percentage trades will be short this morning until something changes. We know that selling the lows of the bear price channel are higher risk, so let’s be patient and sell the highs of the bear price channel, rather than trying to force trades at the lows.

Our plan of attack on crude oil futures using these three price structures:

As price rises I’m selling the PLOD as resistance first, and then with new highs above the PLOD 78.58 I will then look to buy as we re-enter into the range from Friday.

I will also sell the highs of the bear price channel as price rises, using it as resistance.

If we keep going through the highs of the bear channel I will then look to sell at the next level of resistance above the bear price channel.

If price falls I need to be very careful until we get below the 77.00 level. We have major trend line support in two different locations, as well as the lows of the bear channel, which we know will be sloppy.

I’m buying the support levels below me (trend lines, wedge lows, channel lows). I will then sell retracements below the major support of 77.11 so looking for the selling opportunities below the big round number.

I’m selling retracements down to the next level of support which is at 76.35. take profit around .40’s and look for the price reversal for the buy, or the new lower low for the retracements to sell and keep pushing it lower.

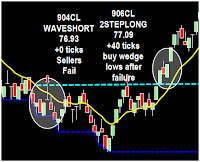

If price fails to make new lower lows below 77.00 I will then consider this to be a failued wave short, and will then buy the lows of the price wedge back above 77.00 big round number

900am EST

Crude oil futures open their pit doors for the day and they push lower into the lows of the bear price channel.

We are looking for FEEDBACK from the markets right now to see whether the sellers are REALLY in control.

935am EST

Mini-Russell futures have three simple price structures, very similar to crude oil futures this morning:

– Outside Day

– Price Wedge

– Bear Price Channel

Outside day tells me to keep selling new lower lows with retracements, at the same time if we break back above the PLOD we then look to buy the failure by the sellers.

Price Wedge tells us to expect fake-out breakouts, so I’m always looking to buy at major support as price falls, and then if we break through that support we then sell a retracement with new lower-lows.

Bear price channel tells us that sellers are in control right now, that can change, but the sell side will be the higher percentage trades until this changes.

If price rises I’m buying above the PLOD 638.1 and the lows of the price wedge. I’m then going to sell the wedge highs at the trend lines overhead and then sell the bear channel highs as the highest percentage trade on this chart.

If price keeps falling I will be careful trading short until we get price below the 628.1 major support below the lows of the bear channel.

We know its going to be hard to sell the lows of a bear channel, so beware. As price falls I’m buying at major support levels, trying to find clues to when the sellers will give up and the buyers will push it higher into the range above us (PLOD).

If we get below the 628.1 I’m selling new lower-lows with retracements.

We will continue to sell retracements with new lower-lows until we test the next major support at 620.1 at that point we will take profit, look for an entry long to bring price back up, or for new lower-lows and we then will continue to sell off with retracements.

1030am EST

The mini mini-russell futures and crude oil futures are both ‘wedging’ which means as price rises I’m selling, and as price falls I’m buying. Looking for the fake-out breakouts after we see this market personality showing through.

Lets plan our attack for the highest % trades the rest of this morning.

Mini-Russell futures price wedge tells us to buy the lows around 637 area and sell the highs around 645 area. Avoid the middle of the range on the mini-Russell futures b/c it will be high risk.