October 21, 2011

- in Uncategorized by schooloftrade

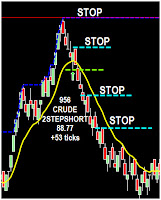

Another Incredible day trading crude oil futures on OPEX

—————————————————————————————————————–

Have you seen our Fully-Automated Trading System yet? Don’t miss this opportunity.

See how Crude Oil Futures automated trading did today.

See how the Russell , E-mini ES, and Euro Futures Automated trading have done this week.

—————————————————————————————————————–

745am EST

We begin with our EMOTIONAL prep on an OPEX Friday, making sure we have realistic expectations for this day of OPEX.

Today is when the volume will be lowest of the entire week as traders have most likely done all their major work already, and today is simple protecting capital and looking for clues for next week.

750am EST

The DOLLAR INDEX is trading in a price wedge, which is one of the BIGGEST Red flags we get as traders.

Combine this price wedge on the dollar index and the OPEX slower volume along with euro currency futures concerns and we may have a potential mess on our hands this morning.

800am EST

We’re looking for crude oil futures to get back below the PHOD 87.12 for a selling opportunity into the ‘reversal-zone’ at the price channel lows around 86.50 for a long position buying the price channel lows.

It will be very challenging to get into a decent trade at the HIGHS of the bull price channel, so be patient not to force long positions into the price channel highs.

810am EST

We can easily see a potential scenario where the dollar index comes back UP into the middle of the range its in already, and the gold futures and crude oil futures tumbles back DOWN into the ranges from Thursday, we will sell below the PHOD.

Keep an eye on that DOLLAR INDEX!

900am EST

Crude oil futures open and the dollar index drops to new lows making crude move higher to new HOD.

925am EST

DOLLAR INDEX is trading at the lows of its range and we need to look for clues from the dollar index to move forward.

If the dollar index makes new lower-lows below this major support we need to keep buying higher-highs with pullback. If the dollar index comes up off these lows, rising dollar index will results in falling prices.

We would ASSUME the dollar index would rise off these lows considering its an OPEX Friday, but we need to wait for PROOF.

1100am EST

Now we need to be very careful trading this OPEX Friday after 11am.

We’ve had an amazing day today, so no concerns there, now I want to conserve capital and CONFIDENCE.

I need to end my week on a STRONG results, so I go into the weekend with confidence.

1115am EST

We waited for some better price action and we never got it after 1100am EST

We know where the markets want to go, we could possibly keep trading, but its not worth the risk.

RISK = losing your profit today, and losing your confidence for MONDAY.

Questions from trade room:

ES Templates for charts and Auto Trader will be up this afternoon.

– Green = when both timeframes are pointing UP and not overBOUGHT

– Red = when both timeframes are pointing DOWN and not overSOLD.

– When its GREEN you BUY

– When its RED you SELL

– Very exciting tool

– Anyone can use it

– Does 100% of the work for you

– Can be used to MANUALLY take your profit.

Joe’s Theory of the Auto Trader:

– We place a lot of pressure on ourselves to earn money while we learn this business

– If I could earn $500/week ($1500/mo) this will take that pressure off of me.

– While you’re learning you are earning with the automated trading system.

Which is better? Auto or Discretionary?

· New trader who cannot follow rules will do much better with an auto trader.

· A slightly-experienced trader with a good control over emotions and understanding rules will do MUCH better discretionary.

You will NEVER be able to compete with the success of a HUMAN compared to a CPU.

– 60% Auto-Trader Winners

– 80% Discretionary Trader Winners