December 1, 2011

- in Uncategorized by schooloftrade

Day Trading Strategy using Crude oil Inventories

Our day trading strategy always uses the dollar index to give us easy clues for the best trading opportunities, and this morning was no different.

We had a day filled with news, and the most important news was crude oil inventories at 1030am EST today. We know how to trade this report, so we were ready for it.

Today at 800am EST the dollar index responded to news from the ECB regarding interest rates on bad debt, and the dollar index tumbled considerably lower. This also caused the other markets we trade to rise higher.

Crude, Euro, gold, all trading at their range highs.

There are 2 important things to consider when something like this happens. First, don’t trade until you see the market start to regain some consistency in movement. Second, we know that ‘big drops mean big pops’ so we expected to see the dollar index come right back up, and the other markets drop back down to their initial trading ranges.

Sure enough, after a few moments of patience the dollar index started to rise off the new lows, and we were ready to profit from selling the highs on gold, Euro, and crude oil.

1030am this morning we had crude oil inventories, which came out with higher inventories and higher demand. We know the DEMAND number is the most important aspect of the news, so we bought crude oil futures when the sellers failed to break major support, and the buyers pushed price above the recent swing high.

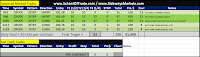

Three Phases of Day Trading Crude oil inventories