August 18, 2011

- in Uncategorized by schooloftrade

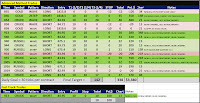

Bull Price Channel Fails; Crude Oil and Mini Russell help us hit our daily goal

We thought today might be contract rollover on crude oil, however the volume is still higher on the 09-11 contract. We will roll forward to the 10-11 contract when the volume exceeds the 09-11 contract.

On days like today where we’re ‘sharing volume’ with the 10-11 contract we don’t really worry about which contract to trade, we worry about the LOWER VOLUME that results in this.

This is unique to crude oil, sharing volume. Most markets will move ALL the volume in one day to the next. Crude Oil is unique in this aspect.

Lower volume during this time of the month will result in less consistent price action and support and resistance.

825am est

Gold is trading at its highs again and we want to sell the highs on gold.

Now with the pullback off the highs wait for the 21, 34, 55, 89range wave long and buy the pullback after new highs.

Gold will be sloppy around the all-time highs so pick your spots and try to be selective as the EMOTIONS will be trading at the highs.

Crude is in a bull channel and we look to buy at support when price drops and buy pullbacks with new higher highs.

If we break through support we can then trade short selling a retracement with the target at the next level of support below us.

Euro is trading sideways with a price wedge so we know to sell the highs and buy the lows. The most challenging aspect to the euro will be sitting on hands waiting patiently for the highs or the lows to be re-tested. Avoid the range from 4300 down to 4200 because its the MIDDLE of the wedge on the 89range chart.

840am est

Crude Oil tumbles down to the 89range BMT which means this is going to be a sloppy area to trade around.

905am est

We traded short with a retracement on crude oil for a big winner, and got chopped up a little on gold futures so far this morning.

Crude Oil is outside day, so lets keep selling retracements with new lower lows.

Crude Oil is in a bull channel on the 89range and a bear channel on the 34range chart.

Plan of attack will be to keep selling new lower lows with retracements, keeping an eye on the major support levels from the 89range as buying opportunities.

So trading short until we run into 89range support, and then take your profit (cover your short) and buy the major support.

935am est

Gold is at the all-time highs so we’re being extra careful with Gold

Crude Oil is in a bear channel, and trading around the 89range BMT so we have to be careful with crude oil.

Crude Oil is sharing volume with the 10-11 contract today so volume is light as well.

Russell is dropping to new lows and we’re selling retracements on the Russell.

Euro is sloppy and trading in the middle of the range, so we need to be careful on the euro as well.

1000am est

Looking for buying opportunities at the channel lows on the Russell

Looking for selling opportunities with new lower lows on crude oil.

Crude oil has major support at 82.69 so look to take profit at 82.75 and then watch for new lower lows to get short again below the support.

1025am est

Change in personality now, everything much slower

1100am est

Another HUGE day of profits here in our trade room, over 300 ticks in the books.

Now we have personality slowing down ahead of Friday’s OPEX and summer Friday.

Lets plan our highest % trades for the rest of the morning.

Mini Russell needs to break above the 673.9 and buy a pullback trying to buy the major support from our channel lows on the 89range chart.

Price action has a lot of open space up to 685.0 so look to extend your runner if you can get price above 75.1 which is the next level above us.

Crude Oil is in the middle of its range, we’re not at major lows, or at major highs, so we need to be patient.

Buying above the next level of resistance (84.00) above me. The price magnet of 84.75 and 84.60 will make the long above 84.00 much easier to get profit out of it.

If we fall to new lows I’m buying 82.69 and then selling retracements down to 81.88 and then looking to buy more there as well.