- in Uncategorized by schooloftrade

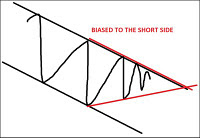

Price Wedge Day Trading Strategy

Disclaimer

———————————————-

SchoolOfTrade.com and United Business Servicing, Inc. are not registered investment or trading advisers. The services and content provided by SchoolOfTrade.com and United Business Servicing, Inc. are for educational purposes only, and should not be considered investment advice in any way. U.S. Government Required Disclaimer – Commodity Futures Trading Commission. Futures and Options trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results. CFTC RULE 4.41 – These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or-over-compensated for the impact, if any, of certain market factors, such as liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. Testimonials may not be representative of the experience of other clients. Testimonials are not a guarantee of future performance or success. No compensation is ever paid in exchange for any testimonials. Testimonials have not been independently verified.

———————————————-